Price Cuts on San Francisco Real Estate are Predictable

Among the strangest phenomenon of the San Francisco real estate market is seasonality. You’d think the largest asset purchase/sale that most people make in their lives wouldn’t be subject to such randomness, but here we are.

The key thing to understand is that buyer demand drives seasonality. Folks are traveling in the summer and around the Winter holidays, so it’s harder to sell home. And during the Winter, the weather is crummiest in SF and homes just don’t show as well when it’s dark and rainy.

Which is to say there is pressure to sell your home in the Fall before the weather turns. That sets a bit of context about what I’m about to show you.

So when do you see the most price cuts in the San Francisco residential real estate market? I did an analysis to find out. The below chart shows the percentage of active listings by month with a price cut over the last five years.

Lo and behold, it follows a pattern! Price cuts generally surge and peak in October. Why then? Sellers are trying to get things sold before the market softens in the winter.

So if you see a home you like that’s for sale in September, by all means buy it. But if it’s just a bit out of your price range, wait till October and see if it’s still on the market then. If they haven’t sold it yet, the sellers may be getting nervous and ready to accept a below-asking price offer.

The Price of Buying a House in San Francisco by Neighborhood

Hi friends, below a data table of a ranking I created showing the most (and least) expensive neighborhoods in San Francisco to buy a home. This data is of September 2024 and is the median price of a home sold in each neighborhood. Below is the infographic you can share. Below that is the raw data for this price guide.

Based on your budget, now you know which neighborhoods to target for your home search. Please note this is single family homes only, not condos. For my San Francisco real estate agent services, please use the Contact form on this website.

Rank Neighborhood Median Price

1 Presidio Heights $7,000,000

2 Cow Hollow $5,425,000

3 Pacific Heights $5,262,500

4 Seacliff $4,725,000

5 Jordan Park / Laurel Heights $4,212,500

6 St. Frances Wood $3,961,500

7 Cole Valley / Parnassus Heights $3,765,000

8 Ashbury Heights / Buena Vista $3,765,000

9 Marina $3,750,000

10 Russian Hill $3,602,929

11 Clarendon Heights $3,560,000

12 Haight-Ashbury $3,500,000

13 Lake Street $3,322,500

14 Forest Hill $2,900,000

15 Lower Pacific Heights $2,895,000

16 Anza Vista $2,854,444

17 Noe Valley $2,729,000

18 Monterey Heights $2,647,500

19 Eureka Valley / Dolores Heights $2,590,000

20 Hayes Valley $2,575,000

21 Duboce Triangle $2,525,000

22 Balboa Terrace $2,455,000

23 Lone Mountain $2,440,000

24 North Panhandle $2,228,500

25 Diamond Heights $2,225,000

26 Sherwood Forest $2,201,000

27 Portrero Hill $2,200,000

28 Inner Richmond $2,175,000

29 Mt. Davidson Manor $2,125,000

30 Forest Hill Extension $2,112,500

31 Corona Heights $2,085,000

32 Lakeside $2,050,000

33 Ingleside Terrace $2,035,000

34 Merced Manor $1,950,600

35 Mission Dolores $1,942,500

36 West Portal $1,940,000

37 Westwood Highlands $1,800,000

38 Glen Park $1,800,000

39 Golden Gate Heights $1,753,500

40 Central Richmond $1,750,000

41 Outer Richmond $1,715,000

42 Inner Parkside $1,707,500

43 Inner Sunset $1,701,071

44 Inner Mission $1,700,000

45 Westwood Park $1,661,500

46 Lakeshore $1,650,000

47 Central Sunset $1,600,000

48 Miraloma Park $1,600,000

49 Bernal Heights $1,550,000

50 Midtown Terrace $1,532,000

51 Parkside $1,510,000

52 Outer Parkside $1,450,000

53 Sunnyside $1,425,000

54 Outer Sunset $1,359,000

55 Portola $1,231,000

56 Mission Terrace $1,215,000

57 Silver Terrace $1,150,000

58 Outer Mission $1,130,000

59 Excelsior $1,125,000

60 Ingeside $1,100,000

61 Crocker-Amazon $1,100,000

62 Ingleside Heights $1,095,000

63 Merced Heights $1,090,000

64 Oceanview $1,053,750

65 Visitacion Valley $1,025,000

66 Bayview Heights $1,007,450

67 Bayview $900,000

How to Sell Your Airbnb Vacation Rental for Top Dollar

Of our four properties, three of them were existing vacation rentals that were listing on Airbnb and Vrbo. Because the homes were already short term vacation rentals, purchasing them was significantly less risky than if they were not. You could read reviews of the homes on Airbnb and more importantly you had a record of their historical pricing and occupancy. You could plug in the exact numbers from the prior owner and get a good idea of your base case scenario with the home.

However, real estate agents and listing websites don’t really make it easy to showcase this information in a way that is accessible to vacation rental investors. Normally you have to email the agent, they need to email the owner, the owner needs to dig around and find the financial information.

So here are some tips for selling an Airbnb or vacation rental.

In the real estate listing, include the link to the Airbnb listing (or the house name or ID) as well as the number of reviews and average rating. If you mention the house has 325 reviews and a 4.98 star rating, people will be excited this is an amazing place. Put it in the real estate listing

Have your Occupancy, Pricing and Revenue information ready. If you’re just on one platform like Airbnb or Vrbo, it’s easy to download the information into an Excel spreadsheet or the “Proof of Earnings” PDF. This information is invaluable for investors and will help you get better pricing if you sell your home. Bonus points if you mention the annual Gross Income in the MLS listing.

Optional. Have your costs itemizing. It’s great if you have a spreadsheet of all your monthly costs like utilities, property management, HOA etc on a spreadsheet for a potential buyer.

Insurance. In your packet of information, include who the current insurance provider is and what the annual premium is. This can help an out of state investor figure out the insurance quickly. Bonus points if you have quotes from Short Term Rental homeowners insurance providers already.

Short term rental license. This is the key thing. Have the short term rental license documented in your packet and steps about how the buyer and transfer it or acquire their own.

The cashflow from Airbnb rentals tends to be significantly higher than long term rentals, so you should be able to sell your home for a lot more if it’s properly documented. Unfortunately, almost no one has this information ready to go when selling their house. Every real estate agent that’s selling an Airbnb short term rental should create a packet with this information.

Umbrella Insurance for Short Term Vacation Rentals & Airbnb

This past month, I was reviewing our homeowners insurance since one of our policies was coming up for renewal. All of our homeowners insurance policies are specifically geared toward short term rentals. We use Proper Insurance, Foremost, and used to used CBIZ as well. Typically home insurance policies do not cover short term rentals for less than 30 days. So if they guests damage the property or get hurt, your homeowners insurance might not cover the damage or liability.

All our short term rental homeowners policies cover liability if someone gets hurt or sues you for something that happens, typically up to $1MM (that amount varies based on the policy and how much you elect).

This is not insurance advice, but above and beyond that liability amount, an Umbrella Insurance policy can kick in and provide coverage after the liability coverage on your homeowners insurance is tapped. You should consult with an insurance professional to verify that. Typically your umbrella insurance provider will require you have your car or homeowners policy with them.

So as part of our review, we called our current Umbrella Insurance policy provider, only to find out that while their coverage applied to rental properties, their coverage did not apply to short term rental properties, since that is a commercial activity. Doh!

Luckily, we worked with an insurance broker that helped us find an umbrella insurance that did apply to short term rentals. So we switched Umbrella Insurance providers to ones that would specifically cover short term rentals. Worth checking with all your insurance providers to make sure they actually cover short term rentals or if you could be out of luck if disaster strikes!

What Kind of Short Term Rental Investment Should You Buy? 10 Questions to Consider

Short term rentals is a generic term that applies to renting to a tenant for a period that is less than a standard residential lease. From that definition, you can see the short term rentals could apply to a diverse set of assets or markets. I thought it would be useful to list a some of the decision points you need to make when choosing what kind of investment you’re making in practice:

Are you investing in urban markets or vacation markets? Urban markets target people who are visiting cities who would be there for work or pleasure. Vacation markets target people who are typically just there for vacation. Both markets carry regulatory risk, but urban markets probably much more so.

Are you investing in a small versus large property. Smaller properties tend to have a higher utilization rate, but at a lower nightly price. You can charge more for larger homes, but they might book less often. Larger homes can be more lucrative, but they carry more headaches and risks of attracting partiers who will disturb your neighbors and trash your place.

Are you going to manage the property yourself or outsource it to a property manager? Self management is more work and more lucrative. It’s also likely you’ll deliver a better experience to your guests because you are really committed to the success of this home. On the other hand, if you use a manager you don’t have to do much work and some of your bills might get covered.

Are you buying this home as a second home that occasionally you rent out, or an investment that occasionally you get to use (if ever)? If you are considering the home to be an investment, you can’t really use the home during prime season and holidays.

Is the home a “fly-to” destination or a “drive-to” one. Some of the most exotic locations in the world require getting on a plane for your customer. Some of the most popular vacation areas are also drives from large markets. Fly-to destinations may be more difficult and expensive to manage remotely, but they might be busy year round. Or, there could be a global pandemic and no one is flying!

Who is your target customer? Is it couples? A family? Multiple families traveling together? Large groups? Batchelor and Bachelorette parties? Family reunions?

What’s the ideal duration of your guests stay? Is it a few nights, a week, a month, longer?

Are you targeting corporate and business travelers or vacationers?

Is this your primary residence where you’re renting a portion of the property to travelers or a secondary/investment property that’s dedicated to short term renters?

Are you buying the home predominately to generate strong cashflow or because you think it’s equity will appreciate over time. If it’s predominately for equity appreciation, does the quality of its property management even matter?

Will all your purchases be in the same location, or will you purchase homes in multiple locations? It’s much easier to scale up if you focus on one market because you know the area well and you already have your “crew” in place. On the other hand, it’s not that much more work to spin up a new property at a completely new location. By investing in multiple locations, you also get some level of diversification to protect against regulations changing or a natural disaster.

Taken together, these questions could be helpful in refining what kind of investments you want to make. Or if you’re trying to a create portfolio of properties, you could balance it across various asset types. For example, you might want 75% small properties versus 25% large ones. Or 10% fly-to properties and 90% drive to ones. Or 60% business traveler properties and 40% vacation traveler properties. Or 67% cashflow-focused properties and 33% appreciation-focused ones. With the pandemic, it becomes very clear how having a diversified portfolio can help you weather unpredictable events.

How Much Does an Automatic Pool Cover Cost?

This fall, we decided to install a gas pool heater in our Sonoma property. The goal is to extend the swimming season year around to attract guests more guests at higher prices. People love swimming pools, but pools are unusable in Sonoma in the Fall, Winter, and Early Spring unless they’re heated. So we did it. Already, we got big bookings for Thanksgiving and Christmas almost entirely because of the heated pool.

However, heating a swimming pool with gas is extremely expensive. We haven’t gotten our first bill yet, but gulp it’s going to be bad. However, so that we don’t waste too much money and resources on heating the pool going forward, we decided to install a pool cover.

The automatic pool cover cost $10,500 for the cover and its installation. A wood box to cover the the apparatus cost another $1,200. So the total cost of this pool cover project was $11,700. Also included in this total price was a water pump that you’re supposed to put on the cover to clear puddles when it rains.

However, we should hopefully save money in the long term be reducing heating costs. Plus a pool cover makes it much safer for families staying at the house with children. On the other hand, these things tend to break and apparently you need to replace the vinyl cover every 5 to 10 years. And pool covers are a bit ugly and also you need to pump the water that pools on top of them when it rains.

Start Here: Quick Guide to Vacation Rental Investing

If you’re interested in buying a vacation rental or Airbnb investment property, here’s a list of the “greatest hits” articles that taken together can give you a quick guide to vacation rental investing:

Who we are: Our investments, about us, and how we accidentally got into vacation rental investing.

Financial Model Template for Vacation Rental Investment or Airbnb

How to Estimate the Revenue of a Potential Vacation Rental Investment or Airbnb (TBD)

How to Estimate the Costs of a Potential Vacation Rental Investment or Airbnb (TBD)

How to Finance a Vacation Rental Investment Property and Short Term Rental Income and Your Debt to Income Ratio (DTI)

How Much Do Vacation Rental Property Managers Charge in Fees?

How to Self-Manage Your Vacation Rental or Airbnb Without a Property Manager

Vacation Rental Investment Deal Memo: We Bought an Earthship!

Thought on Equity vs Appreciation (TBD)

I feel like if you read these sets of articles, you’ll have a pretty good lay of the land of buying and operating vacation rentals. If you want to subscribe to future articles, join the email list here.

My Updated Strategy for Vacation Rental Investments

In one of the first posts on this sight, I laid out the criteria I use for assessing a vacation rental investment. In short the criteria is: is it legal, is there demand, and is the property differentiated.

Those pretty good generic criteria for evaluating any market or property in the world. But as I’m thinking about scaling our own investing, I realized I’m getting a little bit more specific in my particular strategy. My own strategy is limited by my capital and knowledge plus the current landscape of the Coronavirus pandemic.

As such, here’s my particular strategy at the moment.

I’m looking for homes that cost around $250K and can rent for about $200 a night and have a pretty decent occupancy rate. When the mortgage is the only a $1,000 a month you have a lot of breathing room and also potential margin if you can generate $5K in monthly revenue. You also only need about $50-60K in upfront capital to buy a property so the return on capital can be quite high. Needless to say these are pretty rare, but they exist.

Homes should be driving distance from a major metro. At the moment people aren’t getting on planes so at the moment I’m not looking for those kinds of locations. After the Coronavirus people will get on planes again, but they’ll still drive to cool locations. At a later date, I may revisit this criteria but I think over time a portfolio should be mostly drive-to destinations.

Customer understanding. Additionally I should have a pretty good understanding of who the customer segment is and why they are traveling and what they want. For example, a really hot market is Gatlinburg, TN but I don’t really know much about it because its so far away and I don’t know much about what the target customer wants. But if I understand the customer segment, I can help turn the property into something very successful.

Those are probably the three major strategy updates to my criteria at the moment, driven by my own personal situation. If I see a home that fits those criteria, I should make every effort to buy it because they are very rare. The goal of buying one of these home is to turn it into the dominate property in its segment and market, which we’ve mostly achieved so far in our three properties. If I were running an investment fund rather than our own personal capital generated from reinvesting profits, I might target a different set of properties. For example I might target 3 bedroom 2 bath homes that sell for $1MM rather than cottages that sell for $250K.

Any how, defining the “strike zone” of properties you want to buy is helpful so that if a good property turns up, you know to pursue it.

Why I Personally like Short Term Rentals Better Than Long Term Rentals as an Investor

Here’s why I personally like Short Term Rentals (STRs) versus Long Term Rentals (LTRs) as an investor:

Because some STRs are in nice vacation markets, you have a chance to get strong cashflow and appreciation. With LTRs normally you need to pick one. In San Francisco, home appreciation has traditionally be very strong, but high home prices means that rent won’t cover your mortgage and expenses. So you lose money on cashflow but make money on appreciation. In some markets in the Midwest, LTR rents tend to cover your expenses and then some, but the home prices never rise much. STRs can sometimes do both (or they can do neither!).

STRs are a "newer" industry compared to LTRs. It's easier to see potential in a property that no one else sees compared to a LTR because there are fewer people looking at them. A of of short term rental markets are highly competitive, but some are not. Certainly almost all these markets are less competitive than multifamily.

Lots of different ways to add value and express your creativity. The renovations and improvements you add to a home can significantly improve this economic performance. This could range from furniture, the exterior paint color of the house, adding a pool or hot tub. If you like HGTV and interior design, short term rentals will scratch that itch.

STRs (at least where I invest) are fun and about having people have great time. You don't have to worry about evicting someone if they get laid off and can't pay their rent. You have other problems of course, but you don't have to be someone's "landlord" and be responsible for whether they have a home.

You get better at it the more you do it. A lot of the challenge in this business is knowing how to run a short term rental. Once you know how to do that successfully that knowledge is valuable and scalable.

There are a lot of “cons” to short term rentals as well. It’s more active so you’re not passively sitting back and making money and it’s hard to scale (especially compared to apartments and multifamily) because you’re managing lots of subscale min-hotels. It’s also highly competitive and you’re at the merci of platforms like Airbnb and Vrbo.

Dynamic Pricing Tools for Vacation Rentals and Airbnb

Lately, we’ve been exploring dynamically pricing one of our vacation rental using an algorithm rather than manually pricing them. For now, we are doing a one-month trial for one of our properties.

The way dynamic pricing tools work is they crawl Airbnb and Vrbo to see how much people are charging and whether those dates book or not (ie does the date get reserved on the calendar). If they see lots of dates in a market book up that’s a signal it’s a hot market, especially if they are booking at a high price. They may also use calendar data around holidays or historical data to see when prices typically spike.

In the past, we’ve resisted dynamically pricing models because it felt too “extractive” in that you were maximumly pricing things to get the highest price from guests. That’s has the potential to leave a bad taste in their month and could result in negative reviews as well as a less amiable relationship between the property owner and the guest. You want things to be a “win win.”

However, we decided to try things out for a variety of reasons. One, we wanted to use tools to dynamically shift minimum stay periods. For far out stays you want to encourage longer bookings. But if you haven’t gotten a booking yet you want to lower the minimum stay and pricing until you get a booking. Doing this manually is a pain and using a tool makes it much easier. Second, it feels like now is a good time to experiment with new tools because people are mostly just booking at the last minute because of coronavirus. Third, it felt like historically we’ve been our property low relative to the competition, so getting some pricing insights is helpful. Since we now have over 150 very positive reviews for the property we are testing, there is probably some room to increase prices.

In our research, it seems like the main players for dynamic pricing are Beyond Pricing, Wheelhouse, and PriceLabs. After our trial is complete we’ll do a writeup on which vendor we chose and how it went. Some of the vendors charge you a percentage of your revenue for their service. Others just charge you a flat monthly fee.

What To Do If You Get a Bad Airbnb Review as a Host

If there is one thing I don’t like about vacation rentals, it is that you live and die by your most critical Airbnb and Vrbo reviews. Unless you have a nearly perfect review score (or at least over 4.8) people may think there is something seriously wrong with your property. The norm is for people to give 5 star reviews, but not all guests are aware of that norm. So if you get an overly critical guest (or you deliver a bad experience) a really negative review can sink the prospects of your listing.

I have some ideas about how Airbnb and Vrbo can improve the review process to return host burnout (mostly around removing the the impact of outlier reviews), but I’ll post that another time. In this article, I want to talk about what to do if your guest gives you a really bad review like a 1-star. It happened to us once and it was terrible!

When we first bought our home in Hawaii, our pool construction project ran over schedule because of torrential rains. As a result, when a guest checked in there was a muddy mess in the side yard (we paused construction while they were there and we hadn’t advertised to them there was going to be a pool on the property, but it was supposed to have been completed by the time they stayed as a nice surprise). We let the guest know ahead of time about this problem, but nonetheless they decided to stay somewhere else after seeing the muddy side yard. We gave them a full refund and they found a different place, problem solved, right?

Then came the 1-star review.

Because this refund took place the day of check-in, the guest was prompted to write us a review. Since they didn’t stay at the house and there was this issue, they us a very polite review, but gave us a 1-star. Since this was our 3rd review on the property, it gave us a horrible average.

After researching the Airbnb rules, we realized there is not a lot we can do. A guest can only change their review 48 hours after they write it. By the time we saw what they wrote (after we wrote our review of the guest), that time period had already passed. The guests review was all accurate and didn’t have anything that warranted Airbnb removing the review. If the guest wants to delete there review, they can do that, but they have to call the Airbnb customer service line and request that the review is deleted. Given that there are sometimes very long hold times for customer service, this is a big ask for a guest.

So, decided call the guest and explain our situation. The 1-star review was making it difficult for us to be able to operate and get guests. If they would consider deleting it, we would be most appreciative.

To our great surprise, the guest said okay. He would call Airbnb customer service and ask them to delete the review. After a few days, we got confirmation from Airbnb that review was deleted. Phewww, a happy ending in this case. The guest was a really nice person and happy to help.

So what should you do? If your guest gave you a bad review review, but isn’t really upset, I’d consider just giving them a call and explaining the situation. If the guest is upset and not really amenable to changing things, you are probably stuck with the review. I would be very careful you don’t do anything that could get you kicked off the Airbnb or Vrbo platform such as losing your temper and threatening the guest, offering them a financial reward for changing their review, or deleting your listing and recreating a new one from scratch. All these things carry huge risks of being kicked off the platforms.

Vacation Rental Investment Deal Memo: We Bought an Earthship!

This summer, in the midsts of a the pandemic, we bought an Earthship in beautiful Taos, New Mexico. Earthships are off-the grid, self-sustaining, architecturally-beautiful structures designed by Michael Reynolds. Their signature look is a glass greenhouse that uses recycled water to grow plants and also helps regulate the temperature. The rear of the home is buried in the earth which also helps with temperature regulation.

A few months prior, I had emailed a few real estate agents in the area asking about the Earthships they had for sale. I wasn’t seriously considering it as a purchase (given the pandemic and resulting recession), but they were intriguing.

However, out the blue one of the agents I had corresponded with wrote me months in July 2020 later about a property that was going to be brought to market. It was an Earthship that was currently an Airbnb with 200+ reviews and a 4.98 overall rating and an 87% occupancy rate. The list price was $279K and we could buy it before it came to market it if we were interested. The property would be “turnkey” in that all the furniture and contents would com with it. The photography on the Airbnb listing was amazing and we could use that as well.

I spent about a week researching the place and decided to put an offer in this, sight unseen! We would be able to check it on in person later of course, but more importantly we had over 200 reviews on Airbnb we could look at. The reviews were uniformly glowing, and that honestly told me more than looking at a house during a 15 minute walk through would have.

I thought I’d create a little deal memo to show how I assessed the property given my financial criteria for evaluating vacation rentals.

Legality. Short term rentals are legal in Taos County with minimal regulation, though are highly regulated in the city of Taos and permits are hard to come by there. This home is in the county, so it’s relatively safe to purchase a home here. While it’s possible that the rules could change, typically legacy rentals that pay their taxes by the books are grandfathered with permits.

Rental Demand. Taos is a strong rental market and the Earthship Biotecture (the area where all the Earthships are located) is a true landmark attracting visitors year round. Additionally, world class skiing in Taos is a great draw in the winter.

Differentiated Property. This was the key thing about the purchase. This is one of the most unique properties in the world. In my wildest dreams, I couldn’t even picture this property existing, let alone me owning it.

Do the numbers work? At the current owners occupancy rates and pricing, we were projecting a 42% cash-on-cash return. Because it’s off the grid there are fewer utility expenses than a typical property. Because it was turnkey we would basically only have to invest the down payment on the property. All our other properties required a large renovation and furniture investment upfront.

Operations and Team. The real estate agent lived across the street and was also the property manager responsible for cleaning and maintaining the property. This mean we had an experience team ready to go on day 1 to deliver an amazing guest experience. On the negative side, we are really reliant on our awesome neighbor/real estate agent / property manager / house cleaner. If she ever moved away or decided she couldn’t handle the property anymore, it would be a tall order to replace all she does!

So that’s roughly how I thought through this transaction. We stayed at the house for 3 weeks this summer and it was absolutely amazing. You can check out our Airbnb listing here and our Vrbo listing here. Once we have more data, I’ll update you how accurately this deal memo reflected reality once we owned the place.

How to Self-Manage Your Vacation Rental or Airbnb Without a Property Manager

So you just bought a vacation home in a wonderful place. Perhaps you bought it as a second home and want to rent it out occasionally to others. Or your bought it as an investment property and aim to make money from rental cashflow and appreciation.

The next question is how do you manage the property and do you need a property manager?

People are often shocked to find out that property managers for vacation rentals charge around 35% of revenue. So, if you’re serious about making money from rental cashflow there is pretty much no way to make that work using a property manager. What’s more is the manager is never going to give your property the same attention that you will because they have no “skin in the game” and they also manage the properties of many others so their attention is limited. Your property gets a bad review on Airbnb? No big deal for them because they have other properties, but you might be sunk.

But before you decide to self-manage, you need to recognize that you’re signing up for a part-time job as a small business owner of a little hotel. If well managed it might only take a few hours a month, but you’re ultimately responsible for making sure that the cleaners come, dealing with plumbing leaks, or noise complaints. A couple of times a year something will happen that seriously stresses you out! But that might happen if you have property manager as well.

So, if you elect to self-manage, there are two things you need to handle: customer acquisition (getting guests) and operations (making sure the house is clean and ready for each guest).

Customer acquisition is a solved problem. You just post the the property on Airbnb and Vrbo. Potentially you could post it on Booking.com, TripAdvisor or some other local sites as well. It requires work to figure out how to have a great listing, how to price it properly, and dealing with guest messages.

Operations is a bit trickier, but really it involves having a “crew” of people you can rely on. The key person in this system is your housecleaner. I’d suggest you find a housecleaner that you can pay extra to be your feet on the ground property manager who can stop by the house if things need attention and also keep the place stocked with things like shampoo, soap, and sponges, etc. This is the critical piece of your operations so spend a lot of time getting this right. Beyond your housecleaner / operations point person you need to know the right contractors to call on. Have the number on file for a good handy-person, plumber, and electrician.

The reality is that it doesn’t really matter if you live near the property or not. Last time we were in Sonoma we had a stressful problem that a bird got trapped in our chimney. Since we were there, we tried getting the bird out ourselves and it really stressed us out because we couldn’t do it. Ultimately, we called a wildlife specialist who managed to free the bird and safely release it. The fact that we were there didn’t change that the right solution was to call a specialist contractor.

If there is an issue that requires a plumber, you’re going to need to call a plumber whether you live 5 miles away or 5,000 miles away.

Noise Monitoring Devices for Vacation Rentals

One of the biggest risks for an owner of a vacation rental and Airbnb is that you rent to someone who throws a big, loud party. Not only could wreck your house, but the police may get called and your relationship with neighbors could be ruined. If your operate in an area where you need a short term rental permit to operate, you could lose your license and ability to operate.

Of our three properties, two are little cottages that cater to mostly couples. Not much of a risk of a noise complaint there. However, our home in Sonoma is a three bedroom place with a pool that could be tempt individuals to throw a party. As a result, I’ve started researching noise monitoring devices.

Noise monitoring devices let you know if guests are making a lot of noise, which could be the sign of a party or something that’s going to disrupt the neighbors. It’s also less intrusive for guests than video cameras monitoring the property. I once stayed at an Airbnb with outdoor video cameras and I didn’t like the feeling of potentially being watched the whole time.

From my research, the most popular noise monitoring device is from a company call NoiseAware. For $299 you get indoor and outdoor noise monitoring device and two years of monitoring service. I’d say the second most common thing I’ve encountered is people using Amazon Ring doorbells to make sure a big party isn’t happening. Another noise monitoring service I’ve heard recommended is is Minut, which is a $129 per sensor and has free plans for monitoring the devices for $7.99/month plans for advance features. Other companies I have heard about in this space are Netatmo, Aeotec, iHome.

The key feature I’m looking for is an outdoor sensor that doesn’t require changing the battery very often (or ideally one you can plug in to an outdoor outlet. NoiseAware has an outdoor sensor but apparently you have to change the battery on it every couple of weeks which is a nonstarter for us. I’ll update that post as I learn more in my research.

Host Financial Mortgage Rates for Short Term Rentals

I spoke yesterday with a representative from Host Financial about their mortgage program for short term rentals. Unlike convention mortgages, Host Financial provides commercial mortgages for their properties for investors in vacation rentals, STRS, and Airbnbs. The difference is that they underwrite the property based on the property’s financial characteristics, not the owners underlying income and debt levels like a personal mortgage. You do need a good credit score and need money for the downpayment (about 25%) and about 6 months cash reserves put into escrow.

There are a few drawbacks to using a commercial mortgage like Host Financial. First off all the interest rates where about 3 points higher than a conventional interest rate. For a 30 year mortgage in a rural area, the rate i was quoted was around 6.5%. That’s about 3 points higher than a conventional investment loan right now or 3.5% higher than a second home loan. There is also a step down pre-payment penalty for the first 5 years of the mortgage. That means if you pay back the loan early, you pay between 1-5% percent prepayment penalty on the loan balance depending on the year your repay (if you repay right away you pay a 5% penalty). For non-rural areas with good long term rental comps, you might pay about a percentage point lower. If you used floating exchange rate your rate is about 0.25% less as well. Fees on a $400K mortgage were around $12,500. You can also buy down the rates with paying points up front.

So, if you can’t get a conventional mortgage, but have a killer deal, Host Financial seems like a good option for financing a vacation rental. They care more about how that property is going to perform than your debt to income level. The mortgage rates on commercial loans tend to be higher, but sometimes that’s what you need to do to get the deal done.

Short Term Rental Income and Your Debt to Income Ratio (DTI)

When we first got started buying vacation rentals, most lenders we spoke to did not consider any income we generated from our homes towards our debt to income ration (DTI) because they were short term rentals (STR) and did not have a 12-month written lease in place (LTR). If you have a high DTI because they’re not counting your income, you are not able to get future loans. Lately, I’ve been chatting with lenders to get a lay of the new land.

From talking to our broker, lenders will now consider short term rental income as income that can offset your debt under the following circumstances.

If you’re getting or refinancing a conventional mortgage, but not a jumbo mortgage.

If the income shows up on the Schedule E of your tax returns for one or maybe two years. For a long term rental, they will consider the income right away if there is a lease or 75% of the appraiser’s estimate.

How do lenders treat the short term rental income towards your DTI? They take the income (or loss) from your Schedule E and add back in depreciation, mortgage interest, property taxes and insurance. That number is the adjust income for the property. This number is than subtracted from the full mortgage payment to see how much debt will be considered as they calculate the DTI.

So, does that wipe the debt out completely. Our lender tells us in practice that might not happen if you have a big loss b/c of all sorts of losses that they cannot add back in to get your adjusted income. For example, say you bought new furniture, did some repairs etc. Those big losses would give you a negative income and adding backing a few more items might not get you out of the hole.

How Much Does it Cost to Install a Gas Heater for a Swimming Pool?

In a bid to extend our “busy season” of the Sonoma property, we recently installed a gas heater in our swimming pool. The unit we installed was the STA-RITE Max-E-Therm 333,000 BTU gas heater from Pentair.

The cost of installing buying and installing the unit was $4,400. However, we had to run a new gas line to the pool equipment. The previously owner did have a gas line to the pool equipment, but it was no longer functional. The cost of running the new gas line was $2,400.

So all in, installing the gas heater cost $6,800, but a good chunk of that was running a new gas line. Our next steps will be adding a pool cover to better retain heat and an Wifi enable pool controlling panel so we can control the temperature remotely. After that, we need to replace our old solar panel heating system in the spring (the old one is non functional and leaking).

We will let you know what our monthly utility costs end up being for using all this gas. Keep in mind all these prices are in Sonoma, California so on the pricey side.

What’s the Best Lock for a Vacation Rental or Airbnb?

When you are renting out a property to other people, a critical part of the process is the key and lock for getting access to the home. How bad an experience would it be if a guest shows up and they can’t get into the home? Or if they lose their key while out and about and then they call you in the middle of the night.

There are whole range of options from “smart” wifi enabled locks to “dumb” key locks. In all our properties, we use something in the middle: a “dumb” lock that has a keypad and a long lasting battery.

In every house we have we’ve installed the Schlage Camelot Deadbolt Keypad, which is usually about $85 on Amazon.

The biggest pro of this lock is there is no key involved. Just set the code and let the guest know. The guest types in the code and manually turns the knob to open the deadbolt. Because the human is supply the power to turn the lock, it uses very little battery power and lasts a long time. We change the battery every couple of years. The lock “just work” and there is no complications using apps or needing internet access. There are also backup physical keys that we put in a lockbox elsewhere on the property.

The con of this lock is that you can’t remotely change combination or automate the process of giving out custom guest codes or get analytics on when people check in our check out. If you were managing thousands to units, that might be important. But whatever you do, don’t choose an option that involves a key!

Financial Model Template for Vacation Rental Investment or Airbnb

Whenever a friend asks me about whether they should buy a vacation rental, I send them two things. First, I send them my criteria for evaluating a vacation rental investment. Second, I send them a little financial model I made in Google Sheets to evaluate whether the investment will be profitable or not.

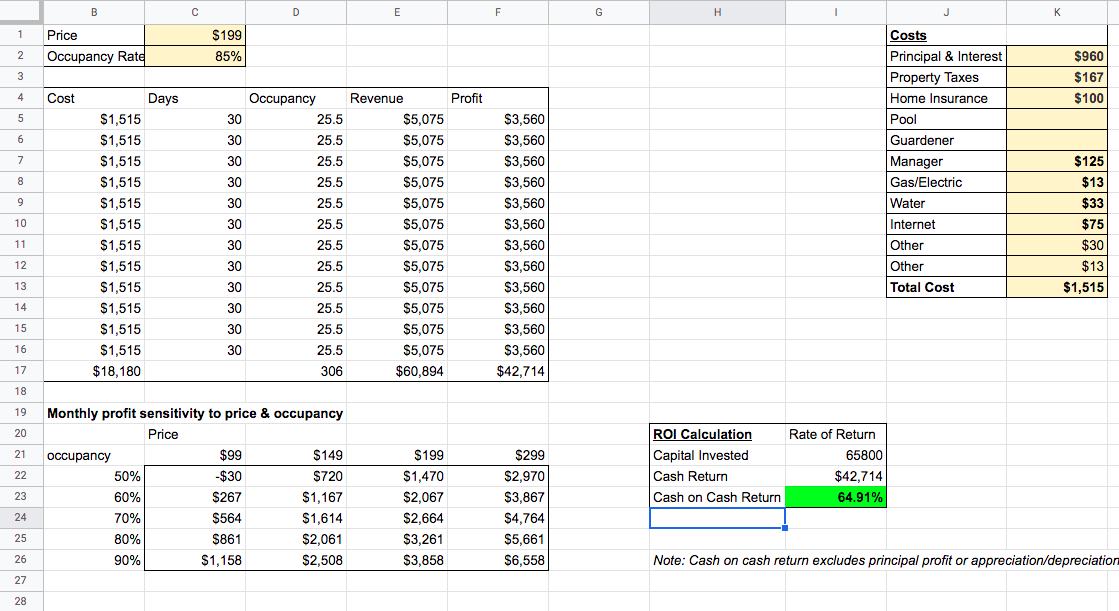

In this article, I wanted to share my simple financial model for evaluating an Airbnb or vacation rental investment opportunity. To briefly summarize, there are three major variables to consider: 1) Occupancy 2) Price and 3) Costs. The result of the model is a “cash on cash return”, ie how much cash are you projected to generate based on the upfront investment.

The the areas in light yellow are what you need to fill out. At the top right you need to fill out the occupancy rate and price. You can figure that out by looking at existing listings on Airbnb and VRBO or by using an analytics service like Airdna or Mashvisor. If it’s non-seasonal market I just input the occupancy rate one time up top. If it’s a heavily seasonal market, I individually input the monthly occupancy.

On the right hand side, I input as many of the costs as I can. I don’t keep a separate line item cost for reserves for maintenance, but some people do (i just look to see if i’m going to create enough margin to cover those inevitable costs). Also, included in the mortgage cost is your principal payment, which isn’t technically a cost, but is cash out the door.

In the green is the output of the model, the cash on cash return. Is this going to be an operationally successful business relative to the investment. That’s the key number I look at and I target returns over 18%, which is of arbritary. The equity appreciate and principal pay down is an additional return, not in this model. I consider that gravy, but actually could be even a greater source or return in the long run.

At the bottom left of the spreadsheet is a sensitivities analysis based on different prices and occupancies you can input. Will you still make a profit if things go worse (or better) than you expect?

If you’d like a copy of this google sheet, click here and request access to the document. Standard disclaimers that you should use this at your own risk, etc apply!

Vacation Rental Investing Markets

This is an ongoing list of markets I monitor for potential vacation rental investment properties and Airbnb. Some of these markets I only know a little about, others much more.

Sonoma, CA

Princeville, HI

Poipu, HI

Destin, FL

Gatlinburg, TN

Pigeon Forge, TN

Taos, NM

Tahoe City, CA

Incline Village, CA

Mariposa, CA

Captiva, FL

Kissimmee, FL

Kihei, HI

Park City, Utah

Springdale, Utah