Financial Model Template for Vacation Rental Investment or Airbnb

Whenever a friend asks me about whether they should buy a vacation rental, I send them two things. First, I send them my criteria for evaluating a vacation rental investment. Second, I send them a little financial model I made in Google Sheets to evaluate whether the investment will be profitable or not.

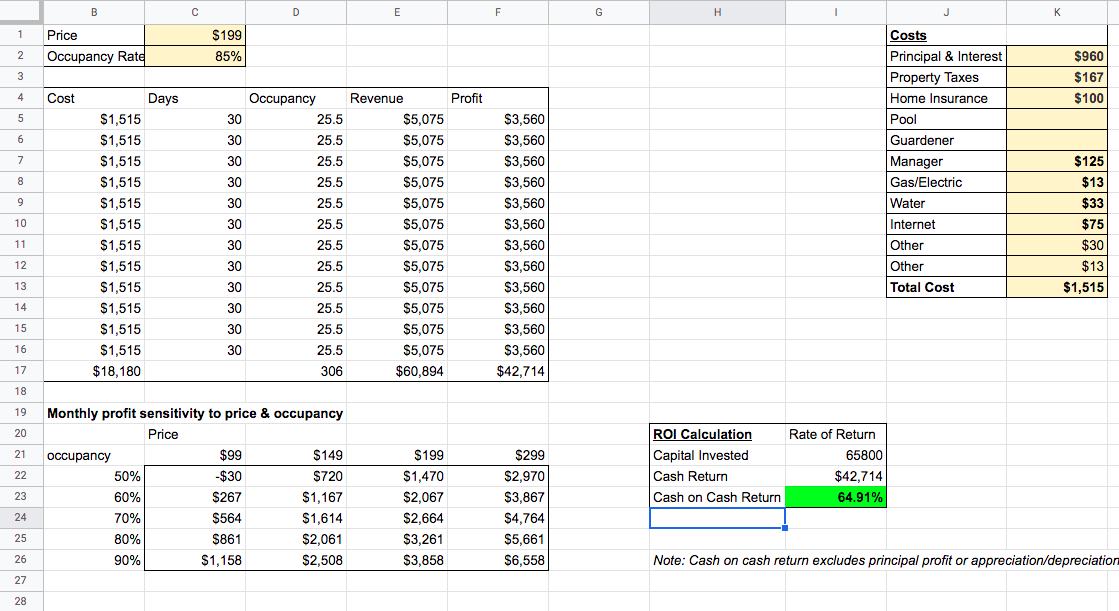

In this article, I wanted to share my simple financial model for evaluating an Airbnb or vacation rental investment opportunity. To briefly summarize, there are three major variables to consider: 1) Occupancy 2) Price and 3) Costs. The result of the model is a “cash on cash return”, ie how much cash are you projected to generate based on the upfront investment.

The the areas in light yellow are what you need to fill out. At the top right you need to fill out the occupancy rate and price. You can figure that out by looking at existing listings on Airbnb and VRBO or by using an analytics service like Airdna or Mashvisor. If it’s non-seasonal market I just input the occupancy rate one time up top. If it’s a heavily seasonal market, I individually input the monthly occupancy.

On the right hand side, I input as many of the costs as I can. I don’t keep a separate line item cost for reserves for maintenance, but some people do (i just look to see if i’m going to create enough margin to cover those inevitable costs). Also, included in the mortgage cost is your principal payment, which isn’t technically a cost, but is cash out the door.

In the green is the output of the model, the cash on cash return. Is this going to be an operationally successful business relative to the investment. That’s the key number I look at and I target returns over 18%, which is of arbritary. The equity appreciate and principal pay down is an additional return, not in this model. I consider that gravy, but actually could be even a greater source or return in the long run.

At the bottom left of the spreadsheet is a sensitivities analysis based on different prices and occupancies you can input. Will you still make a profit if things go worse (or better) than you expect?

If you’d like a copy of this google sheet, click here and request access to the document. Standard disclaimers that you should use this at your own risk, etc apply!